The 6 Factors that Make A Top Index Strategy

All Indexes Are Not Made Equal

Successful portfolio results have a direct correlation to portfolio efficiency. As an investor, you seek to add to results, but enhanced results will not happen on accident. Portfolio efficiency is necessary to achieve a better outcome. Poor efficiency often leads to poor results. When selecting an index investment strategy, often investors consider index funds commonly distributed by large mutual fund providers. Unfortunately, not all indexes are equal. Investors should seek an index strategy that focuses on efficiency rather than pooled index mutual funds. Indexperts, powered by Linden Thomas & Co., draws from over three decades of wealth management experience to build tailored portfolios with individual securities.

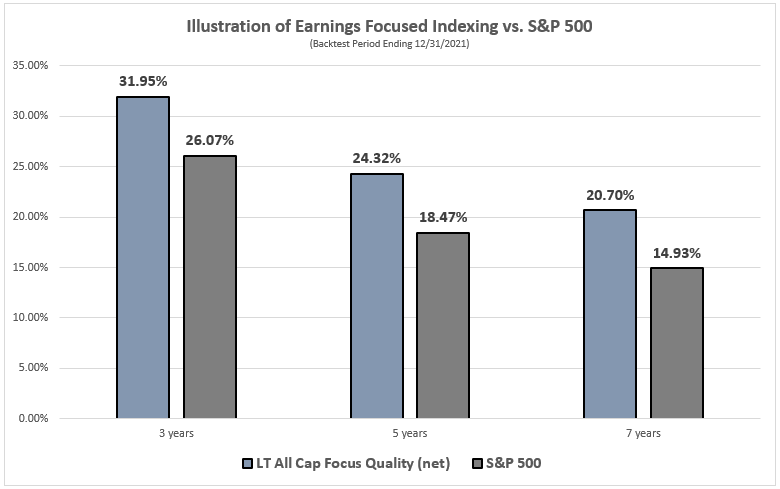

1. Earnings Quality

Many pooled market-cap index funds only replace companies in the index after they drop below the market-cap requirements. This usually occurs after the company's stock has already dropped significantly. Applying an earnings quality screen helps select companies with the highest earnings standards while excluding those that do not.

2. Direct Ownership

Unlike pooled mutual funds and ETFs, where investors are pooled and often penalized when small investors buy or sell, smart investors own their stocks directly. This avoids the herding impact of small investors that can negatively affect returns.

3. Minimized Cost

On top of the (often too expensive) advisor fee, pooled index fund investors will pay an expense ratio for the fund that is stated as a percentage of net asset value. The expense ratio represents the cost of managing and promoting the fund, but does not include all costs that index fund investors will be subject to. Keeping costs low and avoiding hidden costs means more of the investment return goes into your pocket.

4. Enhanced Tax Efficiency

Owning individual securities presents the opportunity for gifting holdings and efficient tax-loss harvesting. It also avoids the unintended tax consequences that can occur with pooled investments. These advantages translate to enhanced tax efficiency and more flexible estate planning.

5. Transparency and Customization

Direct ownership means there is no mystery about what holdings are in your account, and each portfolio is tailored to the client's values and needs. By constructing the portfolio in-house, we provide the opportunity for the client to exclude investments that do not adhere to their beliefs and values (e.g. gaming, tobacco, etc.), and add investments that the client wants to participate in.

6. Education and Communication

Indexperts regularly provides information on market conditions and how investor behavior impacts results. We have found that the best results are achieved by knowledgeable and disciplined clients, so we seek to provide the guidance needed to ensure success.